Financial Freedom Exists

"The key to financial success is a plan."

Let us provide you with a customized, confidential & complimentary financial plan to help you accomplish all of your family’s goals & dreams.

Customized Solutions

Your Financial Future Should Never Include Guess Work

Our team of experienced and knowledgeable financial advisors is here to guide you every step of the way.

We understand everyone’s financial situation is unique. That’s why we provide customized solutions tailored to your specific goals. We’ve got you covered whether you’re looking to:

- Invest for your retirement

- Properly insure your assets

- Plan for your children’s education

- Save for a down payment on your dream home

- or plan that dream vacation

With our proven track record of success, you can trust us to help you make the best decisions for your financial future. Our team of experts will work with you to create a comprehensive financial plan that addresses all of your needs and concerns.

Contact us today to schedule a consultation with one of our financial advisors.

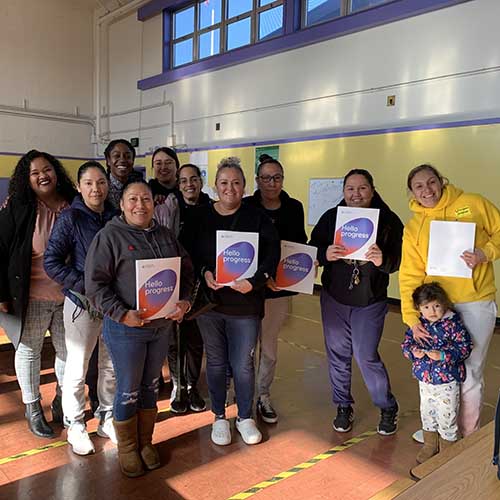

about us

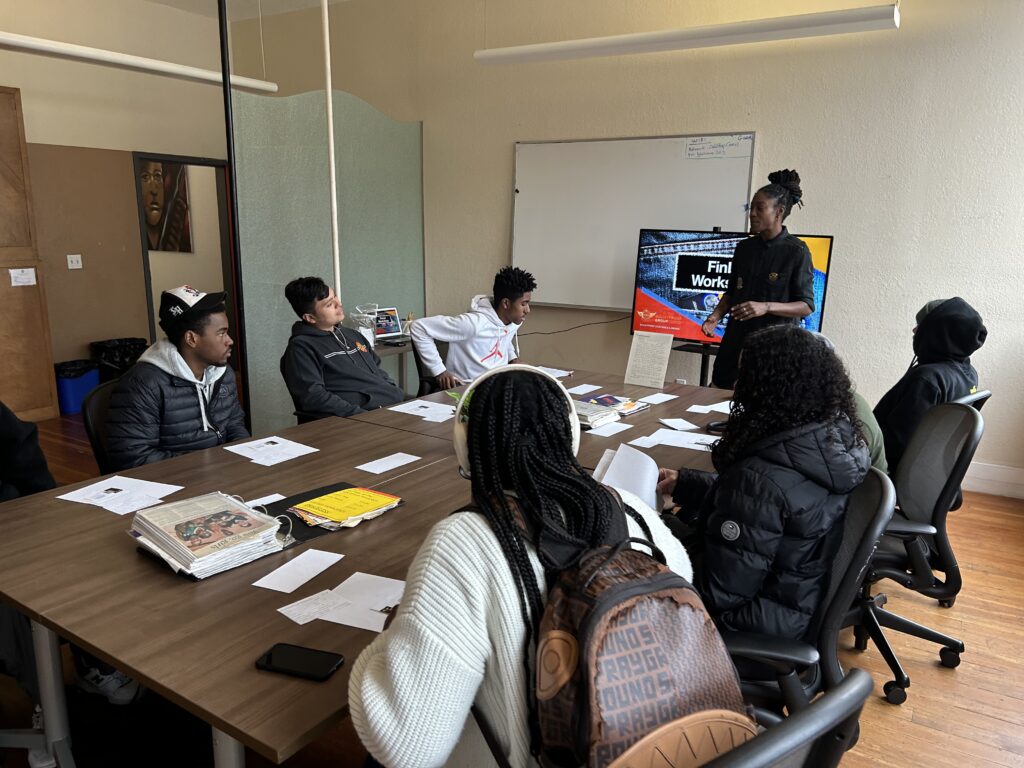

Bulletproof Group was founded in 2017, under the leadership of Investment Advisor Stephisha Ycoy-Walton, and has since grown to have a culturally diverse team of licensed financial professionals.

Leadership is a foundational principle for the Bulletproof Group. This team of professionals exhibit leadership in several ways:

- Expertise: We have in-depth knowledge and experience in finance and investment, which we use to provide effective advice and guidance to clients.

- Communication: We are excellent communicators, able to explain complex financial concepts in simple terms, and are able to listen to clients’ needs and concerns.

- Decisiveness: We make well-informed, confident decisions that benefit clients, demonstrating our leadership skills.

- Adaptability: We stay up-to-date on the latest trends and developments in the financial industry, and are able to adapt our strategies and recommendations accordingly.

- Integrity: We always act in the best interests of our clients, maintaining high ethical standards and building trust with clients.

S. Ycoy-Walton's Qualifications

NASAA – Uniform Investment Advisor Law Examination

The mission

Our mission is to:

- Provide personalized, comprehensive financial planning and investment management services to individuals, families, and businesses.

- Take the time to understand each client’s unique situation.

- Use state-of-the-art technology and tools to deliver our services & stay up to date on the latest financial trends and developments to ensure that our clients receive the best advice and strategies.

- Introduce our clients & partners to the idea of collaborative thinking in an entrepreneurial space.

Professionalism

The team boasts a track record of amazing qualities which allow world class service for all clients and business partners. From our team of financial professionals, you can expect:

- Strong communication and collaboration skills

- Diverse skill sets and expertise

- A commitment to continuing education

- A client-focused approach

- A focus on teamwork and a positive work environment

- Clear roles and responsibilities

-

The use of technology and innovative tools to streamline processes, increase efficiency, and provide clients with access to real-time data and information.

Utilize or Join our team of financial professionals today.

services

Insurance Planning

Our insurance planning services help clients protect their assets and loved ones by recommending the right insurance coverage. We work with clients to understand their insurance needs and recommend a coverage plan that fits their budget.

Retirement Planning

Our retirement planning services help clients create a plan to ensure they have enough money to live comfortably during their retirement years. We work with clients to understand their retirement goals and develop a plan that addresses their unique needs and concerns.

Risk Management

Our risk management services help clients identify and mitigate risks that could threaten their financial well-being. We work with clients to understand their risk tolerance and develop a plan to address potential risks, such as market volatility, inflation, and other potential threats.

Next Generation (College Savings) Planning

Next generation financial planning refers to the process of preparing for and managing the financial needs and goals of future generations, such as children and grandchildren. It can include a wide range of strategies and considerations including options for college.

Mortgage Planning

Mortgage planning is the process of evaluating and choosing the best mortgage options based on an individual's financial situation and goals. It plays a crucial role in personal finance, as buying a home is often the largest investment most people make.

Entrepreneurship

The best chance we have of being financially successful in life is by way of an entrepreneurial opportunity. The best way to ensure success as an entrepreneur is by having a plan and a team of professionals to assist.

our blogs

workshop

frequently asked questions

It is important to respect the advice of a financial advisor like that of a doctor.

- Like doctors, financial advisors have a duty to act in their clients’ best interests and to provide expert advice based on their training and experience. They should also keep their clients’ information confidential and avoid conflicts of interest that could compromise their impartiality.

- Financial advisors cannot predict the future or guarantee any particular investment will be successful.

- Investing always involves a certain degree of risk. A good financial advisor can help clients minimize risk and achieve their financial goals.

- It is important for clients to take an active role in their own financial planning & to ask questions and seek clarification when they are unsure about any aspect of their advisor’s recommendations.

- Clients should also recognize the limitations of financial planning & take an active role in their own financial decision-making.

Here are some FAQs to get you started with taking ownership of your financial future.

It’s important to note that these stages are not fixed and can vary from person to person, but understanding the general financial challenges and opportunities that each stage presents can help individuals make informed financial decisions throughout their lives.

Infancy and childhood During this stage, most financial responsibilities fall on the shoulders of the child’s parents or guardians. They may have expenses such as child care, education, and extracurricular activities.

Adolescence As a teenager, one may start to have more control over their own finances, perhaps earning an allowance or part-time job. They may also start to make purchases and savings plans for the future.

Adulthood During this stage, many adults will have more significant financial responsibilities, such as paying for housing, transportation, and other expenses. They may also start to save for retirement, pay off student loans and other debts and plan for future expenses such as children education, marriage and other life events.

Middle age This stage is characterized by a peak in earning potential, but also by increasing expenses such as home maintenance, children education and other family-related expenses. This stage also requires planning for retirement, saving for healthcare and long-term care expenses.

Old age In this stage, one may have decreased earning potential and may be living on a fixed income such as a pension or Social Security benefits. They may have increased healthcare expenses and other costs associated with aging.

End of life/death It’s important to plan for end-of-life expenses and to make sure that loved ones are taken care of financially after you pass away. This can include making a will, creating a trust, and purchasing life insurance.

Legacy A financial legacy refers to the impact that an individual’s financial decisions and actions have on their loved ones and future generations. It includes not only the financial assets that an individual leaves behind, but also the financial habits and principles that they pass on. It’s important to note that the financial legacy can be passed down to future generations through wills, trusts, and other financial planning tools that can ensure that an individual’s assets and values are passed down in the way they intended. Overall, financial legacy is about leaving behind not only money, but also the values and habits that will help future generations make the most of their resources and achieve their financial goals.

Yes, you can absolutely meet with a financial advisor to get advice without committing to any changes. In fact, it is quite common for people to seek out financial advice as a way to educate themselves and better understand their options before making any major financial decisions.

A good financial advisor should be able to provide you with clear and unbiased advice that is tailored to your specific financial situation and goals. They should be able to explain complex financial concepts in a way that is easy to understand and provide you with options for achieving your financial objectives.

It is important to communicate your intentions clearly to the financial advisor at the outset of the meeting, so they understand that you are seeking advice only and not necessarily ready to implement any changes yet. This will help them tailor their advice to your specific needs and goals.

Keep in mind that a good financial advisor should respect your wishes and work with you to provide the advice and guidance you need to make informed decisions about your financial future, regardless of whether or not you choose to take any action based on their recommendations.

testimonials

Testimonials on this site are from genuine, unpaid clients who have used our products/services. We do not provide compensation to clients for their testimonials, and the opinions expressed are their own. These testimonials are intended to provide information about our products/services and should not be interpreted as a guarantee of results or a promise of performance.

contact us

Contact us with your questions & comments. We look forward to assisting you. One of our team members will return your correspondence within 24-48hrs. Thank you.

Phone

(888) 258-7732

info@bulletproofgrp.com

Location

Bulletproof Group, LLC

5432 Geary Blvd, Ste 565

San Francisco, CA 94121

office timing

Mon-Fri 9a-9p

Sat- Sun by appointment